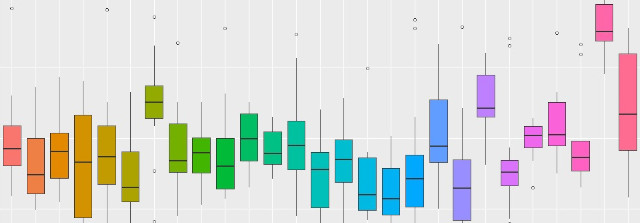

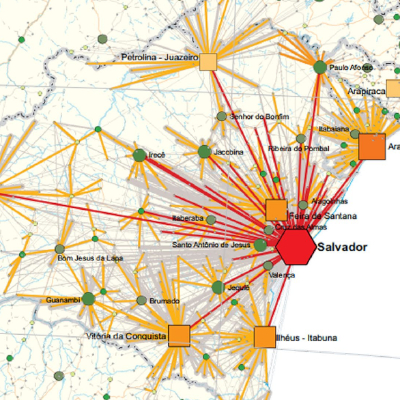

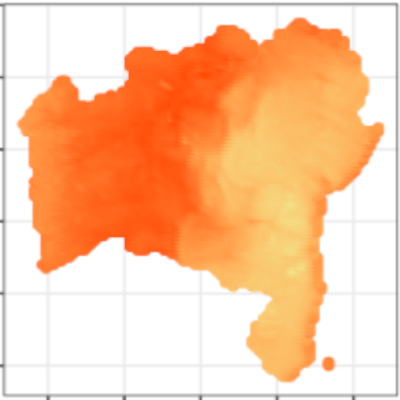

Competition is a relevant element in any open economy. Public policies are necessary to induce economic efficiency and to create conditions to preserve or stimulate a competitive environment. This paper aims to assess the competitiveness of hydrous ethanol price in a period of political, social and economic crises, in 15 Brazilian state capitals between the years 2012 and 2019. We compared the ethanol–gasoline price ratio behavior in two different periods, before and after the import parity price policy implemented by Petrobras in 2016. Mann–Whitney and Levene’s tests, two non-parametric statistical methods, were applied to verify significant changes between these periods. The implementation of changes in Petrobras’ pricing policy from 2016 onwards caused a statistically significant increase in the ratio coefficient of variation in two-thirds of the distribution market and more than the half of analyzed retail markets. Second, overall, the cities that showed statistically significant changes in the median and coefficient of variation in the distribution market price ratio were followed by the retail market. Our findings suggest that government interventions in the fuel and byproduct final selling prices to distributors negatively impact competition between companies that are part of the fuel distribution and retail chain, also affecting the sale of biofuels in Brazil and discouraging the initiatives to use renewable fuels to reduce the emission of pollutants.

AUTHORS:

Aloisio S. Nascimento Filho, Hugo Saba, Rafael G. O. dos Santos, João Gabriel A. Calmon, Marcio L. V. Araújo, Eduardo M. F. Jorge, Thiago B. Murari

Keywords:

ethanol–gasoline price ratio; distribution market; retail market; comparative analysis; Brazilian crises